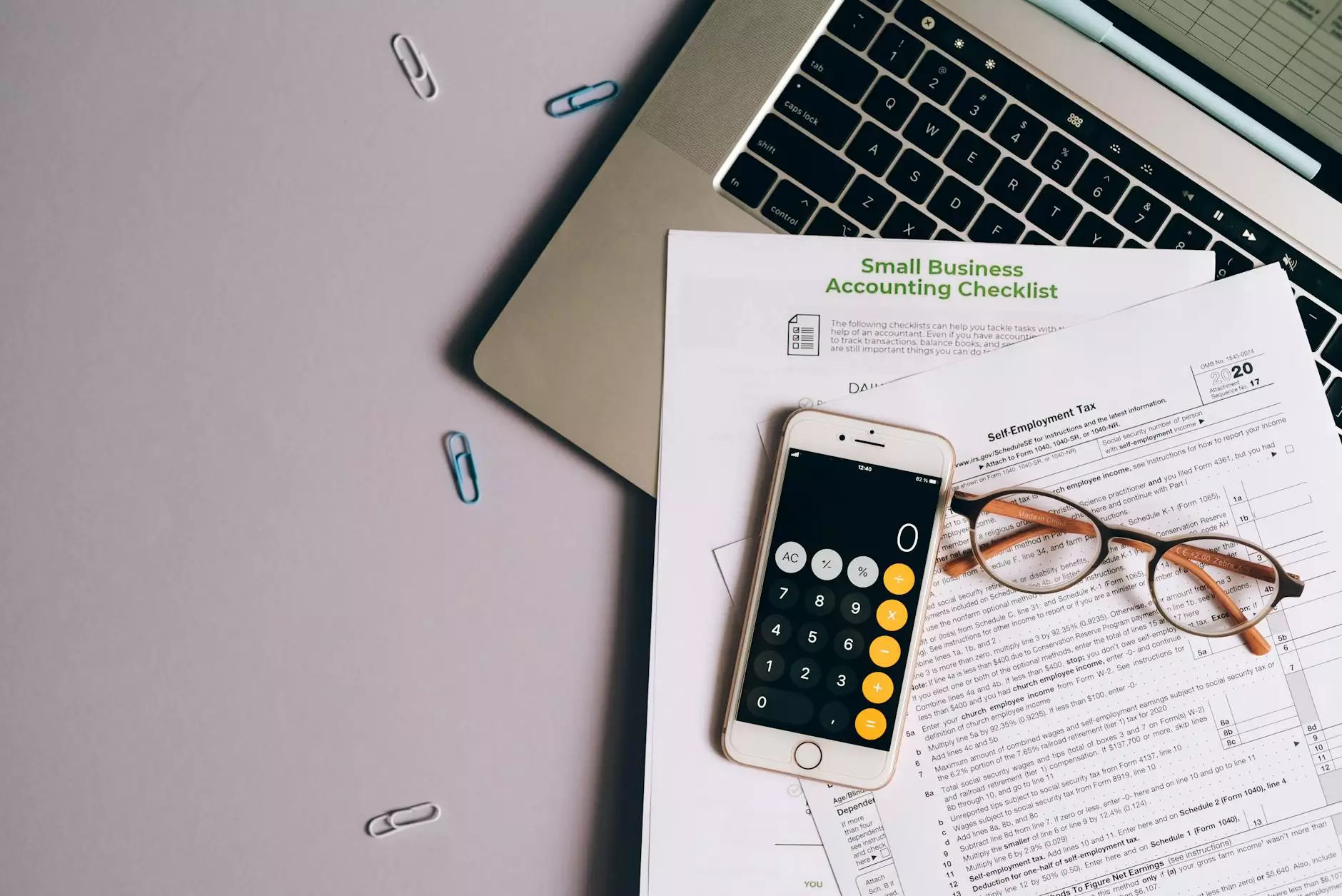

Maximizing Efficiency with **Accounting Packages for Small Business**

In today's rapidly evolving business landscape, the importance of effective financial management cannot be overstated. For small businesses, adopting the right tools like accounting packages is essential for maintaining financial health and ensuring sustainable growth. At Booksla, we understand the unique challenges faced by small enterprises and provide tailored solutions that empower them to thrive.

Understanding the Importance of Accounting Packages

Accurate financial records are the backbone of any business. Without proper accounting, a small business may struggle to track its income and expenses, which could lead to serious financial issues. An effective accounting package streamlines these processes, allowing business owners to focus on growth and innovation.

Key Benefits of Accounting Packages

- Time-saving: Automating repetitive tasks such as invoicing and expense logging frees up valuable time.

- Improved Accuracy: These packages reduce the likelihood of human errors common in manual accounting.

- Better Financial Reporting: Users can easily generate reports that provide insights into their financial health.

- Scalability: Many accounting packages are flexible enough to grow with your business, adding more features as needed.

- Compliance: Stay updated with government regulations and accounting standards effortlessly.

Choosing the Right Accounting Package for Your Business

When it comes to selecting an accounting package, one size does not fit all. Small businesses need to consider their specific needs and how particular accounting solutions can meet those requirements. Here are some key factors to consider:

1. Identify Your Business Needs

Before diving into the vast sea of options available, it’s crucial to outline what your business specifically needs from an accounting package. Consider aspects such as:

- Sales volume

- Type of services/products sold

- Number of employees

- Industry-specific requirements

2. Assess User-Friendliness

A user-friendly interface is vital, especially for small business owners who may not be accounting experts. Look for packages that offer intuitive navigation and easily accessible customer support.

3. Evaluate Customer Support Options

Good customer support can make a significant difference, especially during the early stages of implementation. Choose a package that provides multiple support channels, such as live chat, email, or phone support.

4. Check Integration Capabilities

Modern businesses often use multiple software solutions. Ensure that the accounting package you choose can seamlessly integrate with your existing tools, such as CRM systems or e-commerce platforms.

5. Consider Your Budget

While it’s tempting to go for the most comprehensive solutions, instilling a budget is essential. Determine how much you are willing to spend monthly or annually on accounting software and look for packages that provide the best value within that range.

Top Accounting Packages for Small Business

Here are some of the best accounting packages available today that are tailored specifically for small businesses:

1. QuickBooks Online

Widely regarded as one of the leading accounting solutions, QuickBooks Online offers robust features such as:

- Invoicing and billing

- Expense tracking

- Reporting and analytics

- Multi-user collaboration

The platform is known for its user-friendly interface and extensive support resources.

2. Xero

Xero is perfect for small businesses that are looking for a cloud-based solution. It offers excellent features for:

- Real-time collaboration

- Mobile accessibility

- Inventory tracking

Xero also provides a beautiful dashboard that makes it easy to visualize your finances at a glance.

3. FreshBooks

FreshBooks is tailored for freelancers and service-based businesses. It emphasizes:

- Time tracking

- Invoicing

- Client management

With its simplistic design, FreshBooks enables users to cut down on administrative tasks and focus more on servicing clients.

4. Zoho Books

Zoho Books is part of the larger Zoho software suite, allowing for smooth integration with other business tools. Features include:

- Automated workflows

- Expense management

- Comprehensive financial reports

This package is also cost-effective, making it ideal for small businesses on a budget.

5. Wave Accounting

Offering a completely free accounting package, Wave Accounting is a great choice for startups and freelancers. Key features include:

- Unlimited invoicing

- Expense tracking

- Receipt scanning

Although it’s free, Wave provides essential accounting tools that are easy to navigate.

Implementing Your Chosen Accounting Package

Once you've chosen your accounting package, the next step is implementation. This may involve:

1. Data Migration

Transferring existing financial data into your new accounting package is crucial. Most software provide guides on how to import data from previous systems effectively.

2. Training Your Team

Invest time in training your team to ensure they are comfortable using the new system. Many vendors offer resources and webinars to assist with this process.

3. Regular Backups

Ensure that data is backed up regularly to avoid loss of important financial information. This is often automated in modern accounting packages.

Managing Business Finances Efficiently

With the right accounting package in place, small business owners can manage their financial affairs with greater efficiency. Here are some best practices for financial management:

1. Keep Personal and Business Finances Separate

This is crucial for maintaining clear financial records. Open a business bank account and use it exclusively for business transactions.

2. Maintain Regular Bookkeeping

Set aside time each week or month for bookkeeping tasks. Consistency will make it easier to track expenses and incomes accurately.

3. Monitor Cash Flow

Use the reporting features of your accounting package to keep a close eye on cash flow. Understanding your cash flow helps prevent crises and informs future investments.

4. Plan for Taxes

Keep track of tax obligations throughout the year. Most accounting packages have built-in mechanisms to help you prepare for tax season efficiently.

Conclusion

Choosing and implementing the right accounting packages for small business can transform how you manage finances. With tools that enhance accuracy, save time, and provide clarity on your financial standing, small business owners can focus on what truly matters—growing their business. At Booksla, we are committed to offering the best solutions in Financial Services, Financial Advising, and Accountants to help small businesses navigate their financial journeys successfully.

Contact Us for Tailored Financial Solutions

If you're ready to revolutionize your financial management, reach out to us at Booksla. Our team of experts is here to guide you through selecting and implementing the perfect accounting package tailored to your small business needs.